When I was at the February 15, 2022 Camden County Commission meeting, enduring endless waves of boring Road and Bridge bid openings, I did manage to get a quick look at the Camden County Ordinance Book. There are only a few copies of this book, so I took the opportunity to thumb through it. I took some photos of the ordinances I found interesting because it’s simply my nature to be curious and I’m posting them here because it’s also my nature to be annoying.

These aren’t professional scans since I was taking pictures while the book was open in my lap but nobody has ever accused me of being a professional!

First up is the Camden County COVID Ordinance from March 19, 2020 passed by Commissioners Hasty and Thomas. Certain people want to forget that this ordinance and its addenda ever existed now that election time is rapidly approaching.

COVID Ordnance No 3-20-20:

This was followed by a second COVID Ordinance on March 31, 2020 issued jointly by the Commission and the Health Department. Passed by Commissioners Hasty, Thomas, and Williams:

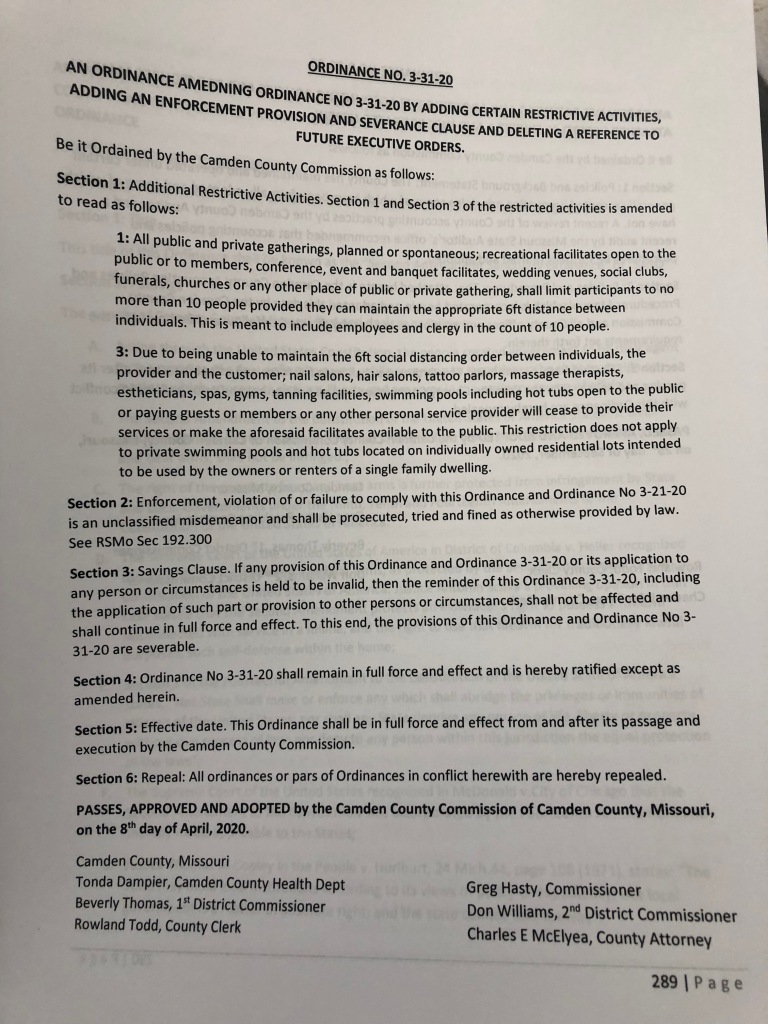

That was followed by an amending ordinance on April 8, 2020 that made it a misdemeanor to violate the lockdown and threatened violators with prosecution. Passed by Commissioners Hasty, Williams, and Thomas:

Well, that doesn’t make it look like the Commission was trying to keep Camden County open.

I also found some ordinances that cover various CID and TIF tax districts within Camden County. I took photos of them because tax breaks for developers drive me nuts. It’s absurd that in this booming economy at the Lake of the Ozarks, developers would need tax breaks to do business in Camden County. It’s also unfair for nearby, existing competitors who don’t get those tax breaks. It is government picking winners and losers. Plain and simple.

Before I start with these ordinances, let me provide a quick explanation of how these tax deals work. Some of this is copied from my earlier TIF article:

What exactly is a TIF (Tax Increment Financing)?

A simplified description is that a government wants to encourage a developer to develop a project in its tax jurisdiction, but the developer wants to defray the cost of the development. The government agrees to return a portion of the property tax revenue and sales tax revenue to help pay for the cost of the development with the hope that the newly developed property will generate more revenue and improve the local economy.

The assessed value of the property is frozen. As the property is developed, the assessed value increases. The difference between the taxes of the frozen assessed value and the increasing value of the developed property creates what is called a tax increment. The owner of the developed property pays this tax increment, but the tax increment revenue is collected and placed in a “special allocation fund.”

The money in this special allocation fund can be used to pay project costs and retire/pay bonds or other obligations used to pay for the project. So the owner of the developed project does pay the tax increment as if they were property taxes, but the money is then placed into a fund that the developer can use to pay for the costs of developing it. So the developer is basically paying themselves.

But it doesn’t stop there. With only a few exceptions, 50% of all sales and utility taxes are also diverted and placed into the special allocation fund. There are even some financing agreements where the government takes out a bond to pay for the project instead of the developer and uses the increment to pay off the bond.

Missouri offers quite a few flavors of other economic development tax districts. This part should be titled: “Why my wife gets angry when we go grocery shopping.”

The TDD (Transportation Development District)

The Missouri Transportation Development District Act was passed in 1990. It authorized the formation of TDD and they charge extra sales tax. They were intended to be used for transportation related projects.

The CID (Community Improvement District)

Another form of location-based supplemental sales tax levy is called a CID. The additional sales tax within the CID is supposed to pay for the cost of community improvements.

The NID (Neighborhood Improvement District)

This final form of additional tax districting is a NID. A NID collects additional tax levies on property owners in an area to “build, maintain, or improve transportation (as well as other public infrastructure)”. Usually these projects have to be within the NID, but you guessed it, it is also possible to use the money to build outside the district if the improvement would benefit the district. Ugh.

https://www.modot.org/cid-nid-tif-and-economic-development-sales-tax

So let’s look at the various tax district ordinances that were in the Magic Book of Ordinances. Frankly, some of these may have expired. It’s always difficult to tell if CID are still really active because governments have an annoying habit of just letting them linger on long after they’re dead in the water:

First up is the Arrowhead TIF. This approved the cooperative agreement for how Camden County would handle the PILOT (Payment In Lieu Of Taxes) on behalf of Osage Beach:

Next is the Ballparks of the Ozarks CID:

The Ozark Bar-B-Que CID? Not sure if this one is still around. Who knows? Maybe in 2012, they decided a serious investment needed to be made into upgrading local smoked meats:

Toad Cove Complex CID. This one passed in 2008, gets 1% of sales tax, and it lasts for 40 years! :

And if Toad Cove Complex gets a CID, we’d better give one to the Toad Cove Resort too!:

The last two are interesting because they’re associated with the Peninsula Development. This was passed in 2015 for a 1% sales tax CID, but I’m not sure what the current status is:

Finally, we have the Ordinance to approve the Peninsula Development TIF that the Commission recently voted for 2-1 with Commissioner Gohagan moving to reject the Ordinance. It’s interesting that his name is on there which makes it looks as if he voted for it. You can read about that crazy meeting with this link:

We have yet to see this project presented in an open Commission meeting since for some reason, the developers were allowed to present it to the Commission in a closed session on October 26, 2021:

And that’s all. I just wanted to share some of the ordinances I found and I hope people get something out of looking them over.

Hi,

I am looking for the county ordinances online, as I figured they would be, but alas, no results in multiple searches. Do you know if they are indeed online somewhere? If not, is the only way to see ordnances to go to the county offices?

LikeLike

They are not online. If you’re lucky, someone might show you a binder that has them all in there. And some of those have been rescinded. I don’t know if anyone is keeping track of them. Try the Commission Office. The County Attorney SHOULD have them but this is Camden County.

LikeLike

Thanks. I’ll check with the county.

LikeLike