The Camden County Gadfly attended the August 29, 2023 Camden County Commission meeting at 10:00 a.m.

All commissioners were present.

The first agenda item was Vote for Best Conceptual Design of Mural for “In God We Trust” – 3rd Floor Meeting Room.

There were no submissions for this mural. Hopefully, some folks can be encouraged to submit their ideas because it is a project that the Commission is willing to pay for.

The second agenda item was Road and Bridge – Employee Reimbursement Policy for Uniforms.

The Commission had the uniform policy ready at this meeting. The policy will give Road and Bridge employees $250 per year reimbursement for work clothing.

This policy was approved and signed by the Commission.

The third agenda item was Camden County Tax Levy Review.

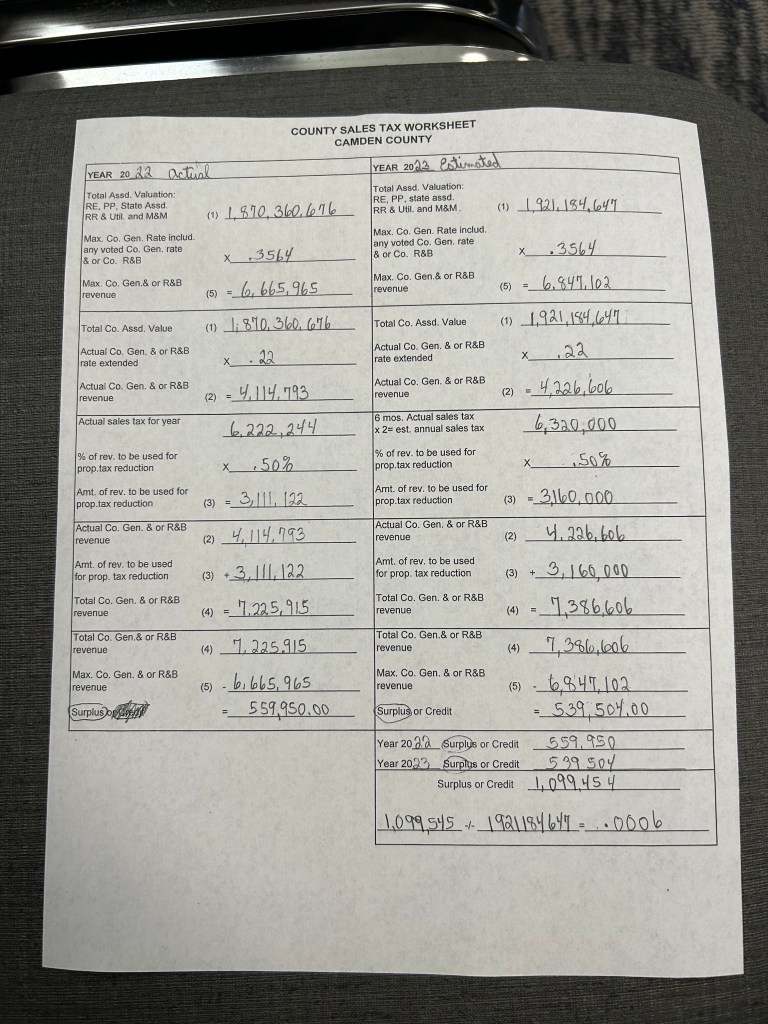

County Clerk Rowland Todd prepared the County Sales Tax Worksheet and presented it to the Commission. He would have given me a copy, but I prefer to photograph it because it feels so much more clandestine. Like I’m a secret agent. (Ignore the carpet.)

Some interesting (to me) information from the worksheet was that the estimated Total County General and Road and Bridge revenue increased by $160,691 in 2023 ($7,386,606 – $7,225,915), but since the assessed county property tax value increased by $50,823,971 ($1,921,184,647 – 1,870,360,676), the Maximum County General & Road and Bridge Revenue also increased.

In fact, the surplus between the two actually decreased from 2022 to 2023. After reviewing his Byzantine calculations, Rowland Todd recommended to the Commission that they keep the levy at its current rate. They did so.

So how does this tax levy stuff work? Let me reach for that bourbon bottle…

This County Tax Levy calculation is all a result of the Hancock Amendment. The Hancock Amendment restricts the amount of tax revenue that can be generated from taxes that were not approved by the voters.

If the total surplus for two consecutive years from the County ½ Cent Sales Tax and R&B Property Tax ever rises above .1% (.001) of the total assessed value of Camden County, the property tax levy will have to be reduced. It’s currently at .0006. Camden County’s advantage is that our assessed county property tax value kept pace with our booming sales tax revenue. (This works great from a revenue perspective as long as we are able to successfully collect property tax from that assessed value)

As the county earns more money in sales tax and the ratio of sales tax revenue to assessed property value increases, the county has to reduce its property tax rate to act as a brake to lower the total revenue. For example, the Commission might vote to reduce the property tax rate from .22 to .21 to reduce the combined revenue amount.

The Hancock Amendment basically tries to keep the county’s annual actual base sales tax revenue at or around .1364 of the assessed value of the county. (Okay, that might have been a decimal too far.)

Is that crystal clear? Congratulations! You’re now among the .1% of the people in Camden County who understand how this works!

The fourth agenda item was Budget Amendments.

There were a bunch of budget amendments and the Auditor explained that most of them were just authorizations to move money around within county departments. He didn’t get into too much detail about dollar amounts, but here are a few highlights:

The Prosecuting Attorney hired another prosecutor and changed some wages for employees.

Maintenance was able to sell some scrap metal so they generated some income.

Several employees earned significant money from overtime. There was some concern from the commissioners that some of those employees were supposed to be salaried, so the commissioners expressed interest in looking into that issue.

I believe that all of the budget amendments were ultimately approved.

And that was that.

In other news, the county’s Tax Sale was rated as a success.

77 tax sale properties were sold out of over 700 available lots. Let’s hope that most of those 77 properties find happy homes and aren’t pushed back onto the delinquent list once their new owners discover that those dogs have fleas.

One thought on “August 29, 2023 Camden County Commission meeting at 10:00 a.m.”