I attended the May 6, 2025, Camden County Commission meeting at 10:00 a.m.

All commissioners were present.

“Discussion of LEST2” was added to the agenda at the beginning of the meeting.

The first agenda item was “Bid Award – R&B – Tire Recap Bid 250128-M.”

Pumps, McKnight, and Purcell Tires were all recommended by the Road and Bridge Administrator.

These bids were approved by the Commission.

The second agenda item was “7MM Cove Agreement.”

If people aren’t familiar with the “7MM Cove” designation, it’s basically the name for Shady Gators, Horny Toad, and Camden on the Lake. Andy Prewitt was present to sign the agreement with the Camden County Sheriff’s Office for uniformed deputies to work a security detail in the parking lots.

Under the new agreement, the county will receive $78.32 per hour per deputy.

This agreement was approved by the commissioners.

In Old Business, there was a lengthy discussion between the Sheriff’s command staff, the Commission, and County Auditor Jimmy Laughlin regarding the LEST2 sales tax revenue and its segregation into a separate trust fund.

There are currently two LEST (Law Enforcement Sales Tax) sales taxes that are each a quarter cent. That means for every 4 dollars you spend in Camden County, LEST and LEST2 each collect a penny. Both of these tax increases were approved by Camden County voters: LEST in 2008 and LEST2 in 2021.

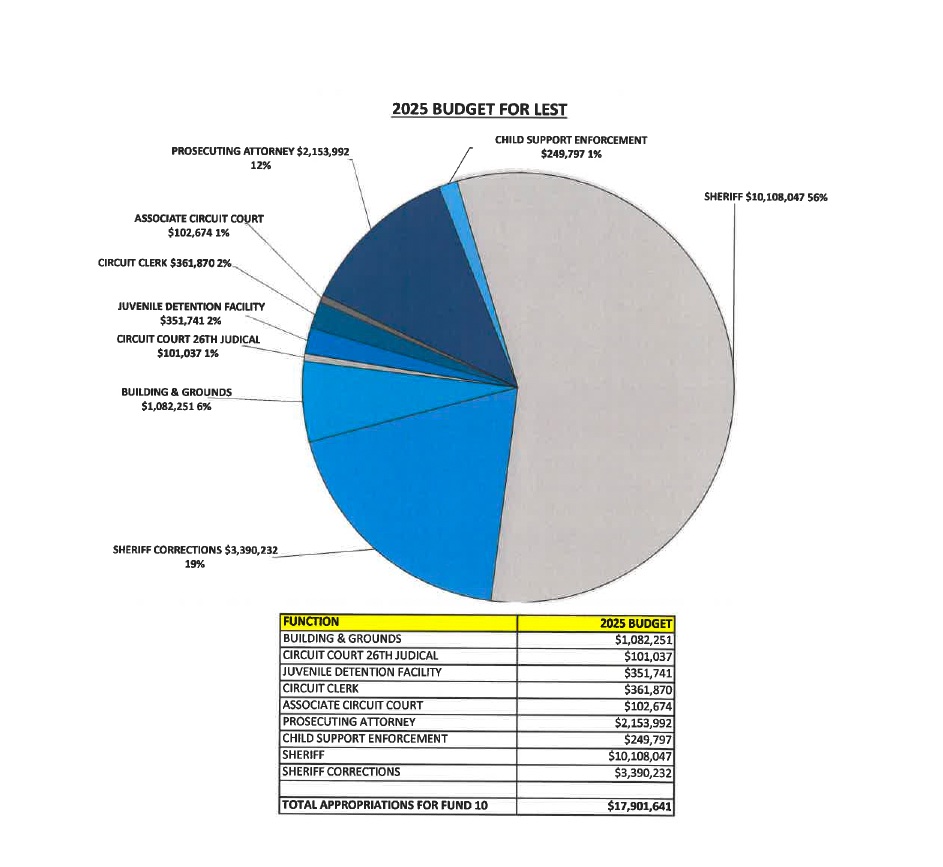

LEST is shared by the Prosecuting Attorney, the Juvenile Detention Facility, Child Support Enforcement, the Sheriff’s Office, E-911, the Circuit Clerk, the Circuit Court, and building costs for the Sheriff’s building and the Justice Center where the courtrooms are located.

LEST2 was intended to go solely to the Sheriff’s Office.

The county’s budget operates based on Funds. You could imagine that each Fund represents a big field that is supplied by water from various “pipes”. Fund 10 is the law enforcement fund, but to make things more confusing it is named “LEST” after the first sales tax increase. It receives revenue from a variety of “pipes” besides LEST and LEST2.

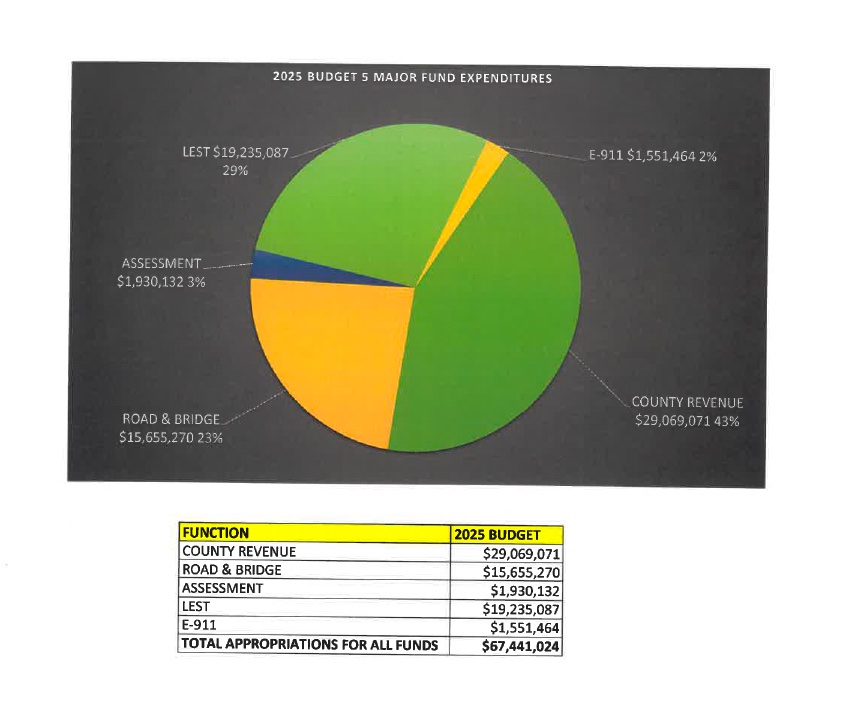

How much money are we talking about? The Camden County Final 2025 Budget projects that LEST and LEST2 will each bring in $3.4 million in tax revenue. Other revenue streams including transfers from County Revenue and from the county’s Half Cent Sales Tax push about $10 million more into the fund.

The problem was that LEST2 was never supposed to be shared with the other departments that are in the LEST Fund. It was specifically pitched to voters as a sales tax increase to raise salaries and buy new equipment for the Sheriff’s Office. You can review Sheriff Helms’ presentation about it here.

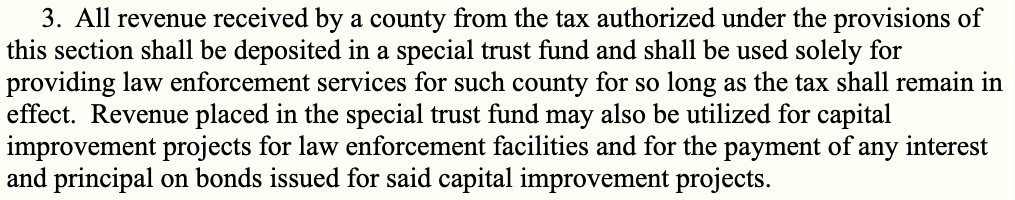

Laughlin continued to state at this meeting that there was no requirement to put the LEST2 revenue into a trust fund, but a quick look at RSMo 67.582 “Law enforcement sales tax” offers up this surprisingly clear directive:

Laughlin explained that he was planning to separate the Sheriff’s Office into its own budget fund so the Sheriff’s revenue streams and appropriations would be severed from the other criminal justice budgets that are part of the LEST fund but this would take some time. He needed help to determine what percentage of certain shared costs would be the sole responsibility of the Sheriff’s Office.

The Sheriff wanted to recover the LEST2 for past years that had been co-mingled with the other revenue in the LEST Fund. The Sheriff’s Office is trying to implement a new pay scale and it’s impossible for them to know if its economically feasible if they don’t know how much revenue they have.

Presiding Commissioner Skelton was frustrated about the entire situation and was baffled why the money couldn’t simply be distributed to the Sheriff’s Office since it was sitting in the budget anyway.

Hopefully, this issue will be resolved soon, but regular readers will observe that this topic has been a constant issue ever since the LEST2 was passed.

And that was that.

To understand some of the Sheriff’s frustration with the budget, it might be helpful to look at a small portion of his department.

E-911 has its own separate fund: Fund 17.

E-911 brings in revenue from an E-911 Phone Tax, Dispatching Fees, and an E-911 Cell Phone Tax. These bring in $543,000 annually. Unfortunately, E-911 will cost $1,551,464 in 2025.

To make up the difference, in 2025, E-911 is budgeted to receive $775,000 from LEST and $283,857 from the 2007 Half Cent county sales tax. That $775,000 is 23% of the LEST tax revenue! And to push up my glasses about it, E-911 isn’t even part of LEST in the budget.