I attended the November 26, 2024, Camden County Commission meeting at 1:00 p.m.

Presiding Commissioner Skelton was the only commissioner present so the Commission did not have a quorum to hold a voting session.

In spite of this, Presiding Commissioner Skelton decided to proceed with the meeting and at least discuss the issues on the agenda.

The first agenda item was “Employee Recognition Ceremony.”

Seven county employees were called up and presented with certificates of recognition by Commissioner Skelton.

The second agenda item was “Discuss LEST II Trust.”

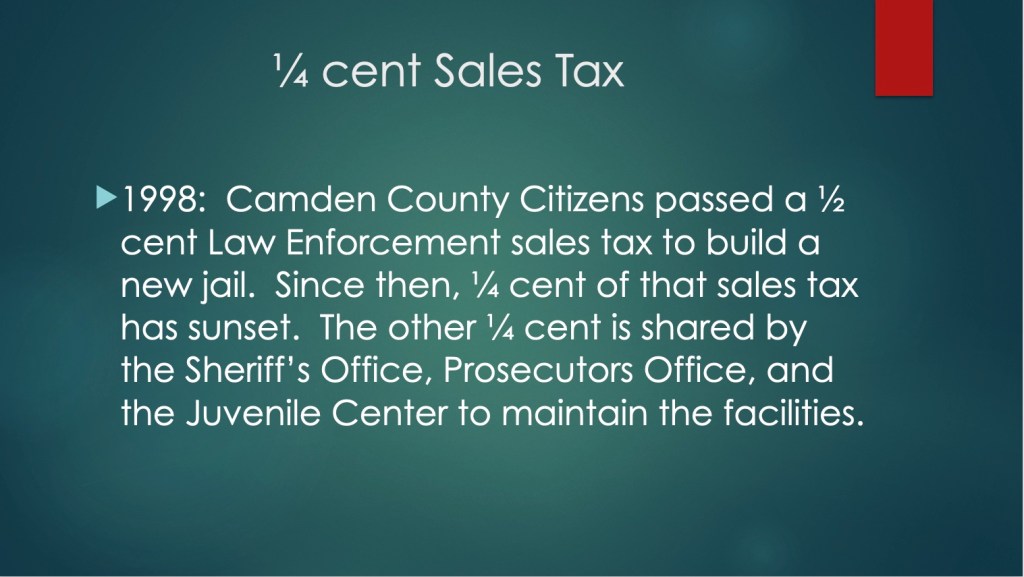

Commissioner Skelton asked County Auditor Laughlin where they were regarding establishing the trust account for the LEST-2 Fund. (This is a quarter cent sales tax increase that was passed by voters in 2021. It was supposed to be exclusively spent on the Sheriff’s Office.)

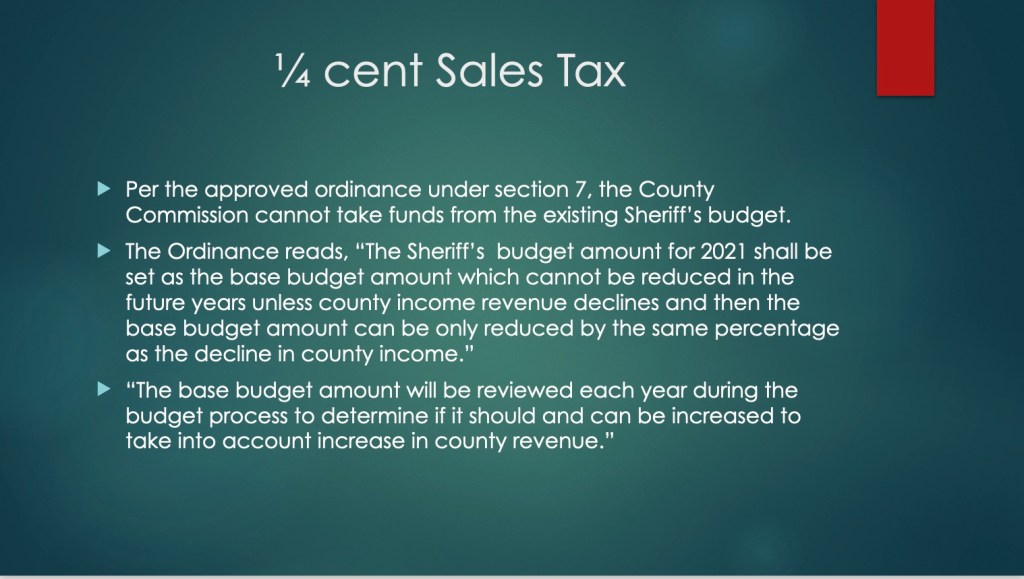

Auditor Laughlin explained that LEST-2 is a dedicated tax. He had spoken to other, experienced county auditors and they didn’t think a trust fund was necessary. He felt that the LEST-2 money should be used first to pay the expenses of the Sheriff’s Office. When the LEST-2 funds were all spent, the LEST-1 fund could pay the Sheriff’s budget. After those funds were exhausted, expenditures could be paid by County General Revenue. Laughlin did not feel there was a need for a separate account for LEST-2.

The representative from the Sheriff’s Office who was present at the meeting objected to this method of sales tax distribution. He thought that the LEST-2 revenue should be kept separate from the other funds.

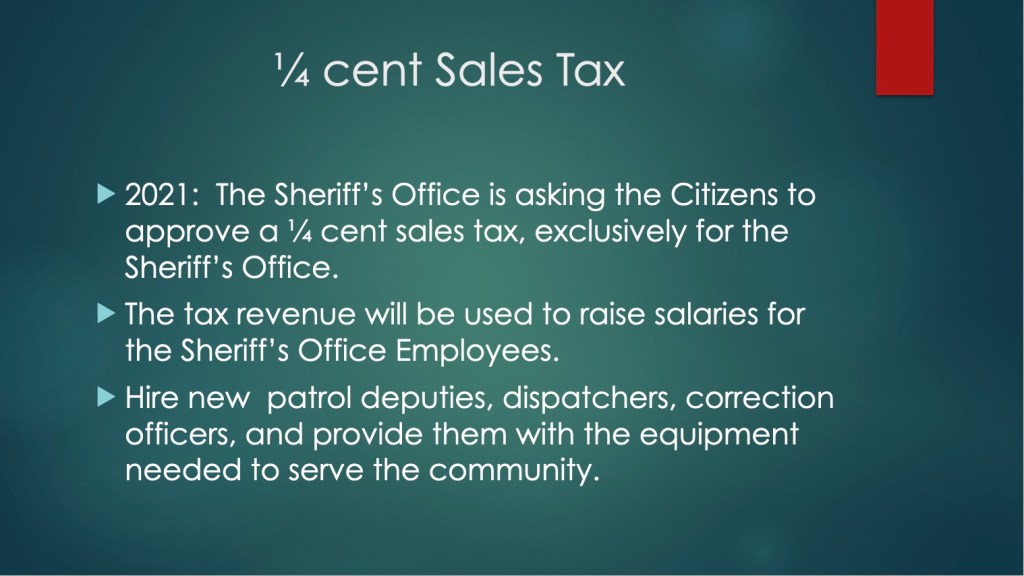

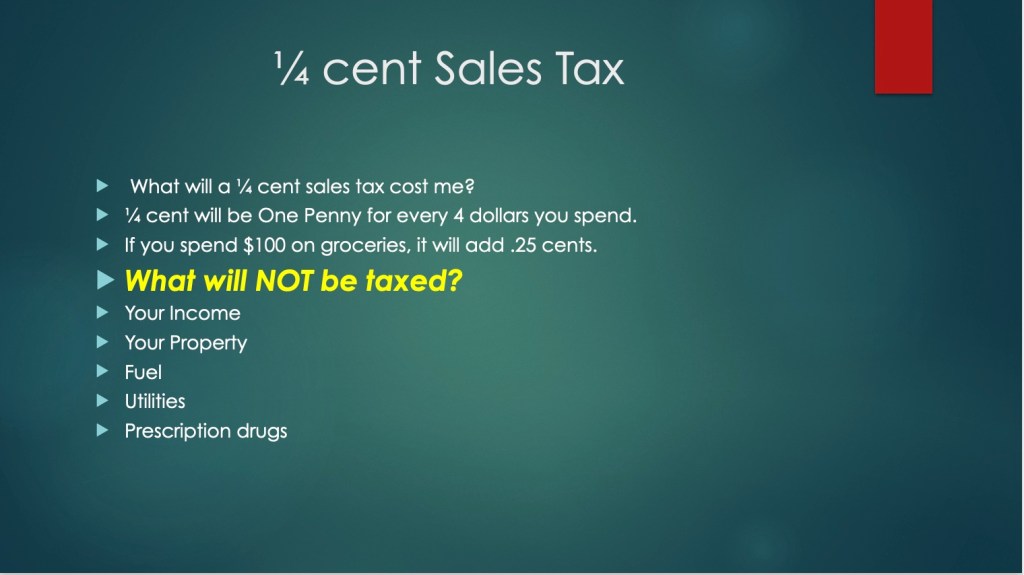

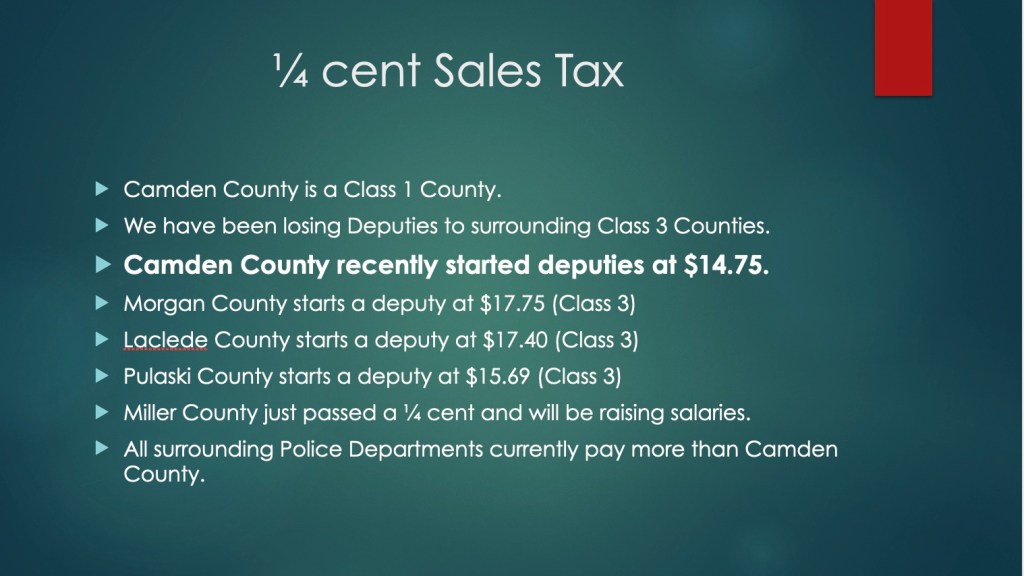

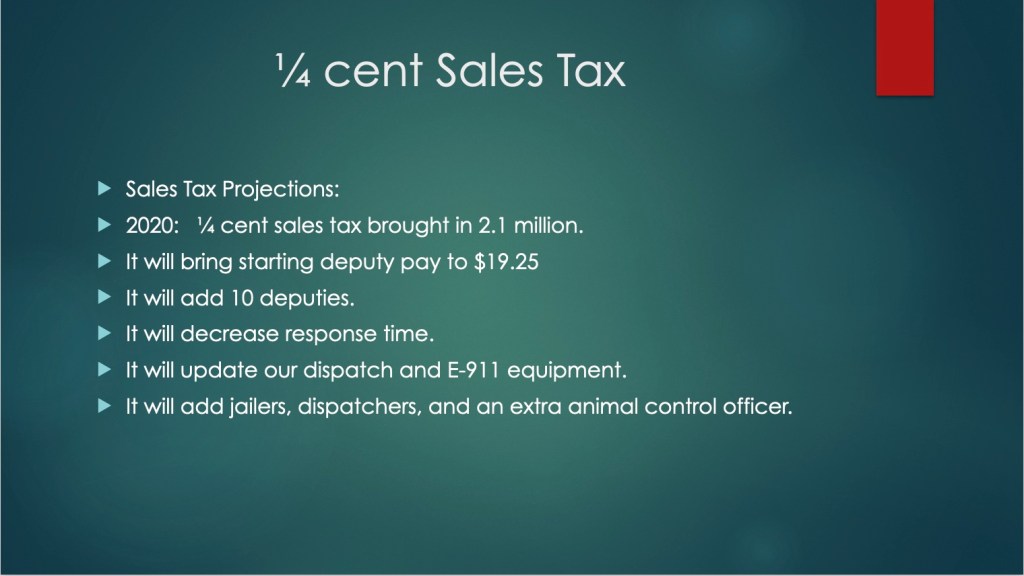

I pointed out that when the LEST-2 sales tax was proposed, voters were promised that the revenue from the tax would be used solely for increasing hourly pay, expanding the number of deputies, and purchasing new patrol equipment. In fact, it had been stressed that there would be no reduction in the Sheriff’s overall budget to absorb the new sales tax revenue.

The solution proposed by the Auditor would simply use sales tax revenue to pay for the Sheriff’s budget until it was determined that the spent amount was equal to what LEST-2 would have brought in. (I have no idea how he would determine this beyond simple guesswork.)

The budget would then be funded by the Sheriff’s LEST-1 share until it was determined by some unknown method that the LEST-1 money had also been exhausted. At that point, General Revenue would be used to fund the Sheriff’s Office?

Was there some issue with determining which portions of the sales tax generated the incoming revenue? I spoke to the County Treasurer and she confirmed that when the county receives its sales tax money from the Missouri Department of Revenue, it is clearly indicated which portion of the sales tax generated each particular portion of revenue.

The County Auditor’s suggestion for LEST-2 is the exact opposite of what was pitched to the voters in 2021. And I can prove it.

Since I am the Camden County Gadfly and an inveterate pain-in-the-ass, I happen to have the actual slide show that Sheriff Helms used to explain this proposed sales tax increase to the voters. Please don’t inquire into my methods, dear readers.

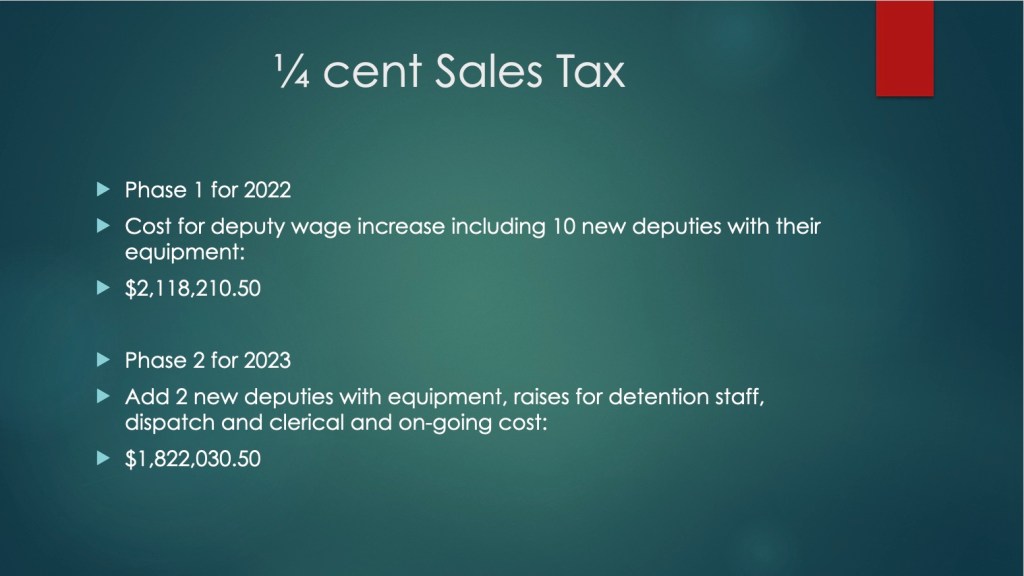

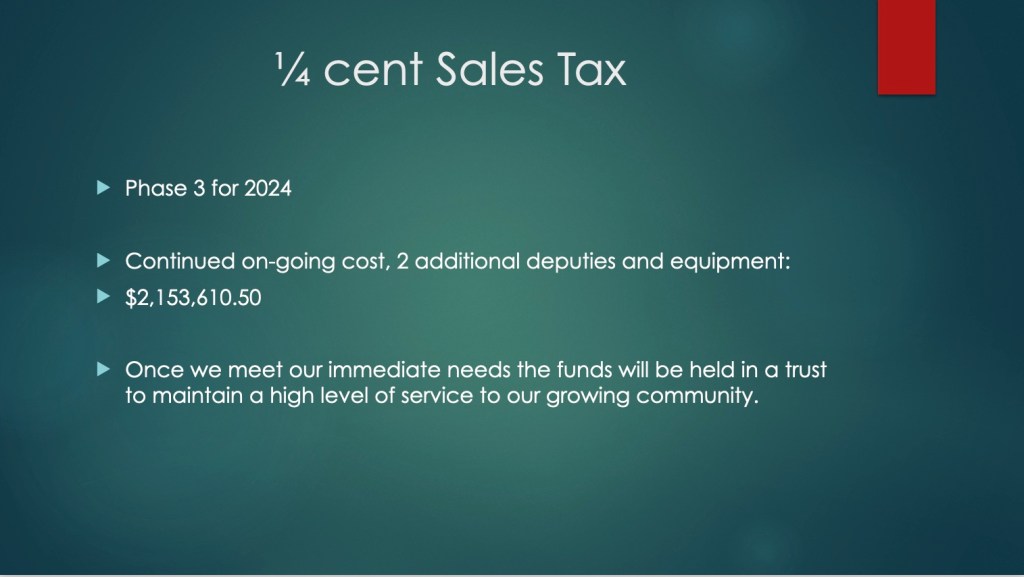

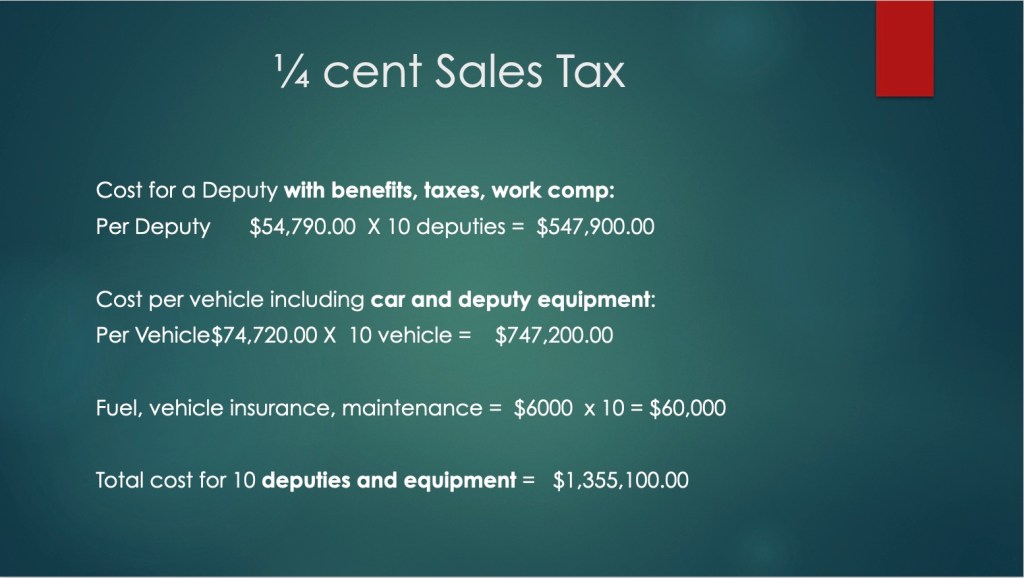

I present to you the slideshow that was presented in 2021 to the Camdenton Chamber of Commerce by the Camden County Sheriff.

When you look at these slides, it helps to understand that the boom in Camden County’s economy means that the 1/4 Cent Sales Tax now brings in between $3-$4 million annually. The extra money from this tax increase was used to raise salaries and the current starting salary for a Camden County Sheriff’s deputy is $22.39/hr. Unfortunately, according to the Auditor’s most recent budget presentation, the department still has 15 unfilled openings.

But back in 2021, when he was presenting this slide show to the public, Sheriff Helms estimated that this 1/4 Cent Sales Tax would only raise $2.1 million annually based on the 2020 budget numbers. As you can see, this tax increase raised much more than that. The 10th slide clearly stated that any leftover funds “will be held in a trust to maintain a high level of service to our growing community.”

So, as you review the slides, ask yourself:

“Why didn’t the County Auditor ensure that the leftover LEST-2 funds were placed into a trust in accordance with the county’s LEST-2 ordinance?”

“What happened to the surplus LEST-2 money that was raised in excess of the anticipated revenue? Was it just dumped into and intermingled with the County’s General Revenue?”

“Why is the County Auditor still resisting the Commission’s efforts to establish an LEST-2 trust that would segregate the LEST-2 funds from LEST -1 and regular sales tax revenue?”

LEST 2

Year Est. Revenue Actual Revenue

2022 $2,100,000 $2,599,945 (Source: 2024 County Budget)

2023 $2,100,000 $3,178,073 (Source: 2024 County Budget)

2024 $2,100,000 $3,029,016 (Source: 2025 Preliminary County Budget)

2025 $2,100,000 $3,400,000 (Source: 2025 Preliminary County Budget)

Questions? I have a few.

Thanks for bringing this to everyone’s attention, Kent Spangler

LikeLike

Good for you for having the slideshow documentation.

Jane Cunningham

LikeLiked by 1 person

LEST they be careful, there will be no more citizens voting for sales tax revenue increases!

LikeLiked by 1 person

That’s what I’ve been telling them.

LikeLike

This is exactly why Camden County residents are reluctant to vote to increase any tax. There seems to be no tracing, transparency, or accountability when taxes are approved.

LikeLike

Outstanding work.

LikeLike