I attended the February 25, 2025, Camden County Commission meeting at 10:00 a.m.

The courthouse parking lot was packed and judging by the number of people praying out in the parking lot, I took an educated guess that some jury trials were starting that day.

Commissioners Dougan and Gohagan were present. Presiding Commissioner Skelton arrived a few minutes after the meeting had started.

The first agenda item was “Bid Opening – 250225 Montreal Building.”

This was a bid to repair the roof of the county building in Montreal. Ellerman bid $17,965. Wright Roofing bid $19,732.

This item was tabled so the Maintenance Department could review the bids.

The second agenda item was “Bid Opening – 250225 Annex Deck.”

There was a single bid from Edge Rail and Screen for $21,611 to replace the deck outside the Child Support Services office.

The Commission accepted this bid since it was the only one.

The third agenda item was “Bid Opening – 250225 Meeting Room Recording Equipment.”

There was only one bid from The Entertainer. Another vendor claimed they sent in a bid, but the county hadn’t received it.

Presiding Commissioner Skelton stressed that they needed to have good recording equipment in the meeting room to ensure that the citizens of Camden County could hear the meetings.

I’m not joking when I tell you that microphones dangling down from all over the ceiling is the current system:

The commissioners were reluctant to accept the single bid so they voted to reject the bid and put out another request for bids to replace the equipment.

Maybe this is the backup system?:

The next three agenda items were for three Sheriff’s Office grants: Dedicated Impaired Driver Enforcement, Hazardous Motor Vehicle Saturation Enforcement, and DWI Saturation Enforcement.

There was a brief discussion between the Sheriff, Commissioner Skelton, and the Sheriff’s sergeant who manages the grant paperwork. These grants are renewed annually by the department. This funding would add a new corporal’s position for the DWI Unit. Commissioner Skelton asked the Sheriff if the department had a policy restricting the use of cell phones in cars by deputies. Sheriff Edgar explained that while the department did not currently have such a policy, all of the vehicles now have bluetooth capability so deputies should be able to communicate hands-free on their phones.

Sheriff Edgar updated the Commission on the department’s current personnel situation. They have 4 new deputies in the Field Training program and four employees enrolled in the Police Academy. In addition, they are interviewing three new candidates so hopefully the department will be at full strength very soon. Good news for the Camden County Sheriff’s Office and I’m sure the Sheriff’s command staff is going to have their hands full supervising a bunch of newly-minted deputies racing around the county, hooking and booking.

Commissioner Gohagan commended the Sheriff’s sergeant for the excellent job he has done cleaning up the department’s grant program.

The Commission approved all three Sheriff grants.

The next agenda item was “ClearGov Accounting Software- Decision.”

County Auditor Laughlin informed the Commission that he had arranged a presentation of the budget software for the Sheriff’s Office leadership. The Sheriff commented that the software would make planning his budget easier. Commissioner Gohagan said that the Commission would be attending a CCAM (County Commissioner Association of Missouri) conference later in the week and they might see some other budget software vendors while they were there.

Presiding Commissioner Skelton and the Sheriff both agreed that the ClearGov program made the budget data very transparent to the public.

The Commission eventually decided to table the matter. The County Auditor mentioned that the price quote they had received from ClearGov was only valid through March which drew a wry laugh from Commissioner Gohagan.

The next agenda item was “Nathan w/Capital Materials Introduction.”

Nathan Herigon from Capital Materials came to the Commission meeting to introduce himself. He brought some of his contractors with him. They discussed the current hardness of local aggregate rock.

Not much else to report about that.

The final agenda item was “Road and Bridge – Hot in Place Remix Discussion.”

Pat Wolf, the Camden County Road and Bridge Administrator, has been doing an excellent job finding new and more efficient methods to repair the county’s asphalt road surfaces. He informed the Commission that he is in discussion with Vance Brothers and Gallagher Hot-in-Place to lock in multi-year contracts for maintenance services. The use of these new contractors has steadily increased the mileage of asphalt roadway the county has been able to repair every year.

In Old Business, the Commission announced they would be publishing the county’s 2024 Financial Statement in the newspaper. Printed copies would be available to those that need them.

The Commission voted unanimously to publish it.

That was the end of the formal agenda, but the real fireworks were about to begin in Public Comment.

Joe McDevitt and Wes Grant came before the Commission to discuss the problems they have been having purchasing tax sale properties from the Collector’s Office.

( Camden County has an annual tax sale where they auction off properties that have property taxes that are 3 years past due. When a property is purchased at the tax sale, the purchaser has to go through a legal process, research the title for any liens or claims on the property, and make attempts to notify the owners of the property that they have purchased it. If the original owners pay the past due taxes before a certain period of time, they retain the property and the auction funds are returned to the purchaser. This is called “redeeming” the property.

If the owners do not redeem the property within the redemption period, the purchaser will receive a Collector’s Deed for the property. After this deed is issued, the property taxes, interest, and penalties are deducted from the auction price. The money that remains is called “surplus funds.” The surplus funds can be claimed by the original property owner. If these surplus funds are not claimed, the surplus money is distributed to the appropriate school district. The auction purchaser then becomes the owner of the property.

Properties on the 4th Sale List have been unsuccessfully auctioned three times and can simply be purchased from a sales list published by the Collector.)

McDevitt and Grant complained to the Commission that they had attempted to purchase properties from the 4th Sale List and the Collector was obstructing their efforts to purchase them. They bought numerous tax-deficient properties from Miller and Morgan counties and had no problems. They said that the Camden County Tax Collector was restricting the number of 4th Sale List properties they could pay for at any one time. It was also taking too long for them to receive the Collector’s Deeds for these properties. They had been waiting nine months to receive their deeds.

The Collector, Teresa Murray, then walked into the meeting with several of her employees. Murray brought a tall stack of files which appeared to be the paperwork associated with the properties in question. Murray explained that the delay on the properties had occurred because she personally reviewed all of the paperwork herself and she had to make sure the process was carried out correctly to avoid legal consequences. She had been staying late at work many nights to get all of the paperwork done. She also claimed there had been issues with some of the street names on the documents that were submitted.

McDevitt and Grant were skeptical about her explanation and asked why this was the first they were hearing about any issues after nine months? They admitted that there had initially been a learning curve with the tax sale procedures, but it was their goal to purchase as many of the past due properties as possible. They would also be paying off the county’s delinquent property tax in the process.

(Camden County currently has $8.5 million in unpaid property tax on its books.)

It got a little heated and McDevitt was obviously frustrated. Presiding Commissioner Skelton had to warn him a few times for getting out of order. At some point, the deputy who was there for security stood up and remained poised for action in case somebody had to be removed from the meeting.

When the deputies start stretching and getting limbered up, you better do some mental calculations to make sure your seat isn’t located in the path between the bouncer and the bounced.

In the end, nobody left the building except of their own free will. I’m not sure there was much resolution to the problem, but at least the Commission was made aware that there was an issue. I was glad the Collector showed up so we could hear her side of the story too.

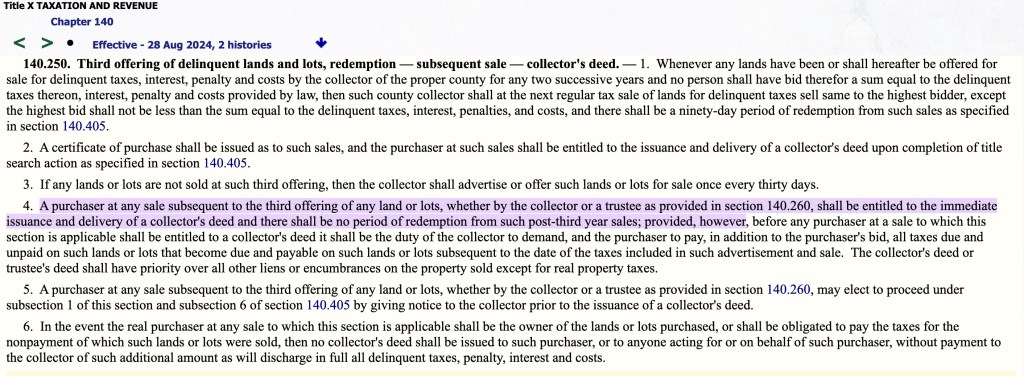

I am a bit concerned with how Camden County is handling their 4th Sale List properties. When the Gadfly opened up the old Revised Statutes of Missouri, section 140.250 states,

“A purchaser at any sale subsequent to the third offering of any land or lots, whether by the collector or a trustee as provided in section 140.260, shall be entitled to the immediate issuance and delivery of a collector’s deed and there shall be no period of redemption from such post-third year sales..”

The 4th Sale properties are “subsequent to the third offering” at the tax sales. The statute states the Collector’s Deed SHALL be issued immediately and there is no redemption period.

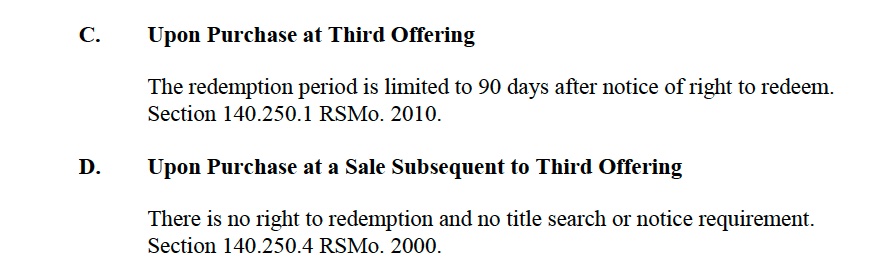

I also looked at the 2019 Missouri Tax Sale Procedure Manual.

It lays out how 4th Sale tax properties are supposed to be processed:

So I’m not sure what the delay is about. Might explain why Joe and Wes are so frustrated.

And that was that.

As I walked outside the courthouse after the meeting, a bunch of the contractors who came to the meeting with Capital Materials were talking out in the parking lot. One commented that it was the wildest Commission meeting he’d ever sat through. I just gave them a smile and told them, “Welcome to Hooterville, boys!”

Thank you. Great information.

LikeLike